Anavex: A Misallocation of Capital

Anavex is a pre-commercial biotech with no viable products, studies or seeming value save for its ability to issue equity at the market

Anavex (AVXL)

Price: $6.36

Fully Diluted Shares Outstanding: 85.5mn

Market Cap: $522mn

Net Cash: $151M

TEV: $371mn

Short interest: 22% / general collateral

The opportunity

· Anavex is a pre-commercial biotech with no viable products, studies or seeming value save for its ability to issue equity at the market. Biotechs with this profile typically trade net cash at best, but Anavex sports a premium with a $522 million market cap. Why?

· This perpetual disappointment has been ongoing for a decade, enriching the CEO through large salaries and generous options grants, with performance tied to simply running trials with no tie to outcome. The CEO Chris Missling has no biotech training, was the CFO of an unsuccessful microcap, and ran investment banking for Brimberg, a firm that was expelled from FINRA in 2013 coincident with the start of Missling’s decade long career at Anavex.

· Biotech investors have been tracking this for years. Jean Fonteneau published on AVXL in 2015 here and another author published on Substack recently as well as another author on Seeking Alpha.

· The Board, which has no life science execs save the aforementioned CEO, appears to offer little oversight while receiving cash and generous option grants

· The share price is down ~32% YTD and 39% over the past year. Anavex is in the capital raising business, not the successful drug discovery business. In addition to an ATM, Anavex has a financing arrangement with notorious fundraiser of last resort, Lincoln Park, which effectively serves as an expensive ATM for further dilution. We expect the company will dilute shareholders significantly on any good news.

· With Anavex burning through its $151 million of cash over the next 4 years, it is a zero – a former Canadian shell targeting retail since its uplisting to enrich executives. With biotech capital markets having dried up, we think the situation is increasingly dire for Anavex which relies on a constant stream of news pumps Just recently the company issued a press release based on a questionable data readout from last December that spurred a 10% share price increase https://www.anavex.com/post/anavex-initiates-regulatory-submission-of-oral-blarcamesine-for-alzheimer-s-disease-to-european. Presumably the company will use this favorable movement to sell more shares through their ATM/ Lincoln Park arrangement.

· Meanwhile, the company delayed its critical pediatric Rett data announcement for 6 months, which is unusual. We expected at some point in the next few quarters they would have to announce those results, which would catalyze its inevitable march to zero. As we surmised, the study did not meet a primary endpoint, resulting in a 30%+ drop in share price, which had risen precipitously in the prior month on the back of a strong Biotech public market move and promotional press releases. Considering the prolific light press releases, the absence of another one after the Rett data release and prior or during the JPMorgan Conference suggests there is no new good news in the offing as that would be an ideal time to generate positive attention

· The Fiscal 2023 press release https://www.anavex.com/post/anavex-life-sciences-reports-fiscal-2023-year-end-financial-results update notably failed to offer any support with the share price falling 10% on what amounted to a pr bereft of substance. See biotech journalist Adam Feuerstein’s snarky take below

· The penultimate press release once again feels promotional as it could easily have been relegated to a footnote in a substantive 8K

· We spoke to multiple people with direct knowledge of Anavex’s trials, readouts, and financings that corroborated our findings

· Why look at this company now? Over the past two months, AVXL's stock price has doubled off its low of $5 along with other small cap biotechs and highly shorted stocks. With 6 months having passed since the Rett data announcement, we expected the delay to continue with marginal buyers fleeing the stock on any sign that momentum has run out. Holders having just seen a double would flee as well, knowing they are competing with the company's Lincoln Park backed ATM. The first part of our thesis played out as expected and now we anticipate an inexorable march to zero.

Description

Anavex is a CNS focused pre-commercial biotech. Its two leading programs are focused on Alzheimer’s as well as Parkinson’s disease and Rett syndrome. It has two earlier stage programs, but major valuation inflections are being driven by the later stage ones.

The company leverages biomarkers to identify patients most well suited to its therapeutics. The lead compound, Anavex 2-73 recently had a readout for Alzheimer’s, which we believe materially impacts valuation. The lead compound Anavex 2-73 is also known as blarcamesine. Along with Anavex 3-71 (AF710B), the other lead compound, focus on sigma-1 receptor (SIGMAR1) binding activities. It is believed that this intracellular chaperone protein, an mRNA biomarker, impacts cellular communication as well as cell maintenance and regulation.

Business

Anavex uplisted to the Nasdaq in 2015 following a reverse merger with an OTC shell. Focusing on a huge unmet need, Alzheimer’s, Anavex’s small molecule approach lands squarely in recent Medicare price fixing concerns. However, the latest Phase 2b/3 data for Anavex 2-73 raises concerns about efficacy as well as transparency. Furthermore, while the company has sufficient cash on hand for at least another four years, it has aggressively used an at the market program and more recently an ATM like financing arrangement from Lincoln Park, likely impairing equity upside.

Investment Thesis

1. Data from the phase 2b/3 were not good enough to merit continued development

2. A suspect history of twisting data

a. September 2023: Changed Alzheimer’s data analysis method after seeing the last patient and the endpoint changed. Likewise, they only presented pooled data for the two dosings of 30mg and 50mg, which likely means they had no statistical significance for each dosing independently. This not only renders the results unworthy of FDA approval but also obscure a path to future studies. Conversations with personnel knowledgeable about the company’s data shenanigans confirms our thesis

b. June 2023: Rett syndrome study announced that had completed dosing in the study and still did not release data, which is highly unusual and a red flag.

c. February 2022: Changed the endpoints on another Rett syndrome study 4 months after study completion and 2 weeks before data release

i. Changed the Rett Syndrome Behavior Questionnaire (RSBQ) endpoint from baseline endpoint to “drug exposure-dependent response” and did the same with Clinical Global Impressions - Global Improvement (CGI-I) endpoint. (Acadia successfully changed baseline data for FDA approval)

3. Safety concerns for Anavex 2-73

a. A quarter of the patients suffered dizziness and 13% confusion. This is significantly more than the control group and in a patient population with Alzheimer’s is logically particularly concerning. Anavex characterizes the safety profile as normal. It is not.

4. Highly dilutive approach to financing

a. At the market: Have an ATM with $142mn left. ATM agreement struck with Cantor and SVB in 2018 and then updated 2020. They sold in 2021 --$79mn (or 5.6mn shares @ ~$14.10 per share).

b. Lincoln Park equity agreement entered into in February 2023, which virtually assures Lincoln Park gets shares at a discount that it can then sell at a profit immediately. Allocation up to $150mn. Until July 1, the company had issued $27mn to Lincoln Park and had ~$123mn left under the agreement.

c. In June 2019 had a $50mn purchase agreement with Lincoln Park that had fully exhausted by September 2021. It issued $24mn and $21mn in 2021 and 2020 respectively in shares.

Financial Overview

· The company is pre-commercial and funding has come from equity issuance. The CEO and CFO have been with the company since the company uplisted to the Nasdaq, with neither possessing a clinical or medical education. The CEO Chris Missling has been in place since 2013, having been head of healthcare investment banking at Brimberg & Co previously. Beforehand, he was CFO of Curis, a microcap that has also been a long term loser for investors. In June he exercised 500,000 options and sold approximately half of them (268,000) at a price of 7.98. He executed options at a strike of $1.6 for total proceeds of $2.14mn. He subsequently exercised an additional 232,000 shares at the same strike and now holds 1,250,210 shares. In other words he sold approximately 20% of his shares. In 2022 Missling received total compensation of $6.8mn, or approximately 1.3% of the market cap, and in 2021 he received total compensation of $9.4mn

· The CEO compensation amounts and structure raise concerns. The CEO’s employment agreement specifies that stock options are not tied to successful trials, but rather completing trials, which is not aligned with creating shareholder value

“one-third of which shall vest on each of (i) the date of completion of ANAVEX2-73-AD-004 Phase 2b/3 trial in Alzheimer’s disease, (ii) the date of initiation of ANAVEX2-73 imaging-focused Parkinson’s disease clinical trial, and (iii) the date of initiation of ANAVEX2-73 Phase 2/3 Fragile X clinical trial.” Subsequently, options were issued to the CEO based on 4 equal tranches vesting with similar milestones not requiring shareholder value creation “(i) topline data readout of ANAVEX2-73-RS-003 EXCELLENCE clinical trial in Rett Syndrome, (ii) completion of Clinical Study Report for ANAVEX2-73-AD-004 Phase 2b/3 trial in Alzheimer’s disease, (iii) topline data readout of ANAVEX2-73 Phase 2/3 Fragile X clinical trial and (iv) publication of ANAVEX2-73-RS-002 AVATAR clinical trial data”

· The CEO’s total compensation creates concerns as well as its sheer size given the market capitalization of the company and its status as precommercial for over a decade. He receives a base salary of $700,000 based on a 2023 agreement and a cash bonus up to 20% of his base salary. Additionally, he was granted 1,000,000 options (500,000 June 14, 2022 and 500,000 June 27,2022 for fair value respectively of $2.6mn and $3.47mn)

He exercised the 500,000 options at a strike of 1.6 that were set to expire in July 2023. He has 5.5mn options exercisable from 2024 through 2030 and additional 2.05mn options with expirations from 2030 to 2023

· In aggregate, the CEO owns in 7.6mn shares or options or 8.8% of 79.6mn share count (he sold 268,000 options so he now has beneficial ownership of 7.32mn) or 7.6% on a fully diluted basis.

· Board compensation also seems high and may present conflict of interest with management. The CEO serves on the board as well. Board members each received over $400,000 in compensation for 2022 with cash of $25,000 for 4 members and $41,000 for the audit chair. They all received option awards of $382,120 (options vest over 3 years). There is no PhD in life sciences nor a life sciences scientist on the board; there is a doctor of osteopathy that has been involved in clinical trials

· Sadly, foundations such as Michael J. Fox’s have allocated resources, most recently ~1mn to a trial of Anavex 2-73 for Parkinson’s. Given the readouts to date, this money is being wasted. Likewise the International Rett Syndrome donated at least .6mn for a phase 2 trial of Anavex 2-73 for Rett syndrome. Not only is retail shareholder wealth being destroyed, but non profit foundations are expending resources.

Deep Dive on Investment Thesis

1. AD-004 safety – Anavex claims “Safety profile similar to placebo with corresponding treatment emergent adverse events largely moderate or mild (dizziness most common)

Treatment-emergent adverse events included transient dizziness, mild to moderate in severity, 35.8% of patients during titration and 25.2% patients during maintenance versus 6.0% during titration and 5.6% during maintenance with placebo.

2. Anavex 2-73 (blarcamesine) AD-004 Phase 2b/3 Alzheimer’s

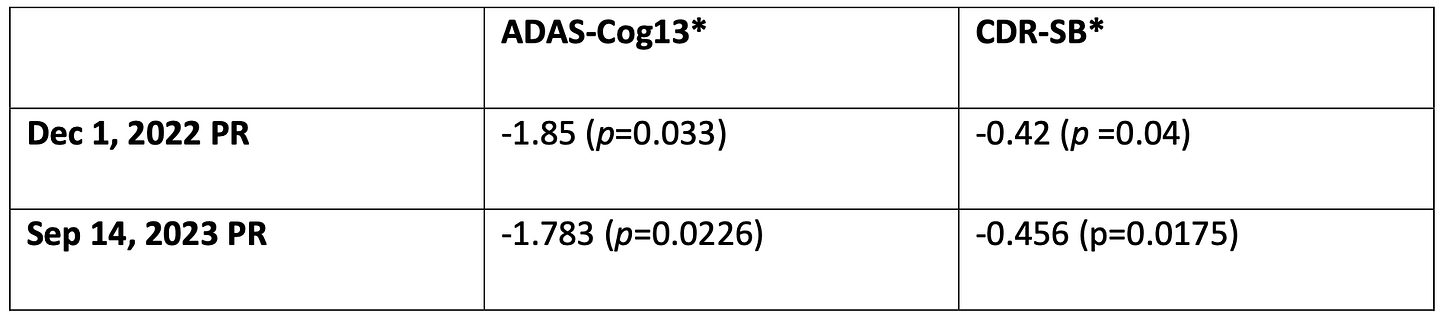

Two "co-primary endpoints" of ADAS-Cog and ADCS-ADL and a "key secondary endpoint" which is CDR-SB. The trial was designed with 3 groups that are randomly selected, placebo group, a 30mg dose group, and a 50mg dose group. The mean score was changed from an earlier PR in December 2022 of mean score from baseline to 48 weeks between treatment groups and placebo group to last-squares mean (LSM) for the same period and groups

3. Clinical endpoints relied on mixed model for repeated measures (MMRM). For statistical significance, each primary endpoint has to have p <.05 or one of the primary endpoints has p < .025. Based on LSM the p value for ADAS-Cog13 was .0226 and the p value for CDR_SB was .0175. However, the data for the 30mg and 50mg were pooled, which suggests (since they did not provide it separated) that independently neither treatment group would have had statistical significance

The FDA could not approve a drug without knowing the doses and it is not clear they have shared broken out data with regulators so there is no clear path to value creation

Financials

Not a lot to say given this is a pre-revenue business. They have cash on hand of $151mn as of September 30, 2023 and are burning ~$8mn a quarter.

Catalyst

· Virtually impossible the FDA will approve based on the data shown to date and a future phase 3, which may not even be warranted given the phase 2b/3 results

· Further equity issuance to Lincoln Park creates a death spiral

· Pediatric Rett data from June just announced and as expected missed the primary endpoint; it is highly unusual to hold data and it seems reasonable that had the data been positive, particularly as the CEO exercised 500,000 options shortly after the trial completion was announced, it would have been released. The company as it has done in the past is looking to redefine success.

Target price

· $0 – there is a long history of changing endpoints, lack of efficacy, and now adverse events. There is no basis for the assets to have value

Risks

· Alzheimer’s is a large addressable market with strong interest in an effective therapeutic. If another Alzheimer’s company had a positive readout, Anavex’s stock would see a short term rise in sympathy. This risk is mitigated by Anavex’s aggressive use of its purchase agreement with Lincoln Park

· Takeout risk. Given the attractiveness of the space, Anavex could theoretically be an M&A target if their drugs did show promise. Our review of the trials and irregularities in their data indicate this is very unlikely.

· The company has demonstrated an ability to market its trials, corporate appointments, and commercial opportunities pumping its stock price. However, over the past year the stock is down 60%

· Given the company has significant cash on hand for at least a year and a half, it could buy assets with promise from myriad insolvent biotechs, which would rejuvenate the pipeline

· Recently hired an SVP of regulatory that had been a VP at Otsuka. However, his linkedin profile shows a 2 year gap between his previous employment

· High short interest presents the common concern of a short squeeze with borrow recall.

· A recent press release, “Anavex Initiates Regulatory Submission of Oral Blarcamesine for Alzheimer’s Disease to European Medicines Agency (EMA)” exemplifies both the risks and downside opportunity. This submission feels like more smoke and mirrors; as Adam Feuerstein commented on data release last December

· This data presented more questions and reaffirms skepticism about the efficacy of the drug and commitment to scientific integrity. Further, we suspect that the press release and accompanying positive bump in share price will be used by the company to sell shares to Lincoln Park, which should lead to a share price retracing quickly. As a result, this pr related share price move presents an even more compelling opportunity to short