Genelux: Even the insiders are fleeing

A 20 year old unremarkable oncolytic viral immunotherapy company, IPO’d at the start of 2023 lacking any notable investors, questionable science, and insufficient runway

Name Genelux

Ticker GNLX

Price ($) 12.64

Shares Outstanding (M) 26.72

Market Cap ($M) 337.85

Net Debt ($M) 27.97

TEV ($M) 309.69

Short Interest: 3.91%

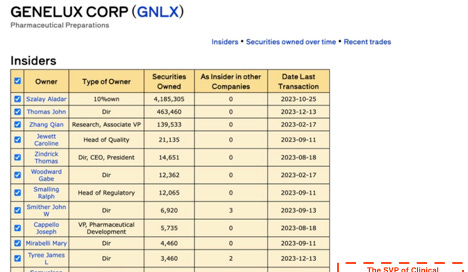

Genelux has little to nothing to show for its 20 year existence. Its underwhelming IPO last year raised less than expected affording only a year’s worth of cash to hit a triple bank shot on its Phase 3 study. Insiders agree with massive insider selling including by Tony Yu, the SVP of Clinical Development who sold his entire stake last year, culminating in December when he exited the remaining 50% of shares.

Description

Genelux, a 20 year old unremarkable oncolytic viral immunotherapy company, IPO’d at the start of 2023 lacking any notable investors, questionable science, and insufficient runway. One year later, the company is banking on a favorable readout of their lead program in small cell lung cancer as they do not have enough cash on hand since an investor in a private placement declined to fulfill his funding obligation as the company detailed in its Q3 release

Adding to the bleak picture, Genelux has pursued 3 solid tumor types, notoriously hard to treat, suggesting that the readout would not be expected prima facie to be successful. With a single one arm trial of 27 patients and no statistical significance with unexceptional results, the company is betting on results being even better in a far more challenging large randomized trial. The lead drug candidate Olvi-Vec is also being tested for NSCLC and Ovarian Cancer, with Genelux claiming that it not only kills cancer directly, it enhances antigen presentation, stimulates tumor-specific response, and converts the tumor microenvironment into an immunoreactive one despite no conclusive clinical proof in 2 decades of research. These aforementioned properties would theoretically make Olvi-Vec not only directly, but indirectly a powerful therapeutic. A separate drug, V2ACT is being tested in pancreatic cancer and V-VETI is an animal health product candidate.

Investment Thesis

1. Despite being around for 20 years and having what it considers a favorable phase 2 trial, the company was unable to attract any notable investors or investment banks for its IPO

2. Even the CEO seems to have one foot out the door, serving as executive chairman of Aeromics since 2018. He has been with Genelux CEO since 2018.

3. The founder of Genelux, who has sued the company, owned a fifth of the company pre- IPO, sold ~8% of his position in the last 4 months.

4. The company’s clinical optimism is based on a questionable dataset in Ovarian Cancer; the data are unremarkable in the context of other drug trials for the same condition, are obfuscated by use of Avastin, lack any randomization due to it being single arm, and may in fact be worse than presented due to 3 of 27 subject results being inconclusive.

5. The company at its current funding is due to run out of runway in 1 year, prior to the phase 3 randomized Ovarian trial readout in 2025

a. A private placement was undertaken in 2023, but an investor responsible for $22mn of it has balked at sending money. The placement was done at $20/ share while the company trades ~40% below this price now

b. Milestones prior to runway being exhausted offer no comfort; one is launch of a phase 2 NSCLC in H1 ’24 and the other is a Phase 1b readout of SCLC in H2 ’24, which there is no basis to believe will be successful, nor statistically significant

Financial Overview

· Genelux had $27.1 million cash at the start of Q3 ’23. With private placements of $27.5mn, there was supposed to be sufficient runway until Q1 ’26. However, $24mn of the private placement was ultimately not funded. $2mn has subsequently been received, but $22mn from another investor was withheld without any indication the investor will fulfill his contractual obligation.

As it stands, there is sufficient cash to get to Q2 ’25, roughly the readout timing of the Phase 3 Ovarian trial.

“the Company had cash on hand in the amount of $29.9 million. During the nine months ended September 30, 2023, the Company closed its initial public offering (IPO) and two private placements and received $37.8 million of gross proceeds from the offerings. The Company also received commitments through the private placements for the funding of an additional $24.0 million. Initially the additional funds were to be received by November 15, 2023, but, in November 2023, the Company agreed to extend the funding deadline for $2.0 million of the remaining committed investment amounts to March 31, 2024. The investor who was obligated to fund $22.0 million of the remaining committed investment amounts has not made such payments and has indicated that he does not intend to comply with his investment commitments through the private placements. We are currently evaluating our options to address this investor’s non-compliance with his contractual obligations.”

· The company entered into a licensing agreement with Newsoara, granting it Greater China rights in exchange for up to $171mn in payments. In 2022 the company recognized $11.1mn in revenue less income tax of $1.1mn. Income in 2023 was $0.2mn

· Currently the company is burning more than $5mn per quarter

Deep Dive on Investment Thesis

· The firm's lead candidate is Olvi-Vec, which is in Phase 3 for the treatment of platinum-resistant/refractory ovarian cancer [PRROC]. This drug first entered the clinic in 2008 and still has yet to produce any statistically significant data

The trial that Genelux rests its hopes on was an open label, single arm with 27 patients, muddled data, and heavily treated patients, whose PFS and OSS fell within the other drug candidates’ ranges

There are a whose who of potential competitors (Amgen, AstraZeeca, Boehringer Ingelheim, JNJ, Merck, Daiichi Sankyo and a host of others) in this space. No one has succeeded in many years save Amgen’s limited oncolytic for localized use of melanoma

· There was such lack of interest that the IPO was delayed from fall of ’22 to winter of ’23 and downsized form $30mn to $16mn

No existing shareholders purchased shares at the IPO

The investment banks that ran the IPO are virtually unheard of, ie they could not even entice a well-known boutique bank during a biotech winter

The Benchmark Company and Brookline Capital Markets took Genelux public

· The SVP of Clinical Development, previously VP of Clinical Operations, who has been with the company for 21 years sold out of his entire position with less than ~10% being a 10b5-1

· If the one of the most senior clinical figures in the company has divested his financial interest in the company, why would anyone have confidence in the upcoming readout?

https://insiderpeek.com/company/GNLX

Why does the opportunity exist

· Unexpected financing difficulties mean that the already precarious situation is now even worse

The company needs to rely on an unproven trial for NSCLC to get additional funding on more favorable terms

· This company would be a short even without the funding shortfall; the science is weak with a history of at best mediocrity

Historical and Projected Financials

· The company has generated some licensing revenue from its deal with Newsoara, amounting to $11mn in 2022, which is meaningless since it is effectively one off and they have already burned through it

· Historically, the company, as with most biotechs, generated no revenue independently

· There is $1.9mn in debt

Catalyst

· SCLC -Olvi-Vec + chemotherapy has a readout in 2H ‘24

· NSLC (adjuvant maintenance – Olv-Vec + chemotherapy) will have a Ph2 regulatory Submission expected 1H ’24

· Ovarian cancer (platinum-resistant / refractory) – Ph3 OnPrime/ GOG-3076 (Olvi-Cev + chemotherapy) results expected 2H ‘25

This trial is called OnPrime and evaluates safety and efficacy of Olvi-Vec with platinum and bevacizumab (avastin) for patients with platinum-resistant/ refractory ovarian cancer

Valuation and why

· $0 target

The drugs have shown no statistically significant therapeutic effect in 15 years

The company will be out of money and unable to raise as the private placement shenanigans demonstrates

· To be considered successful, the phase 3 will have to show tumor regression, which is notoriously challenging in solid tumors that are platinum resistant combined with an underwhelming single arm study as the only basis for any optimism

Risks

· Newsoara, which has already paid $11mn, could pay more and relieve the financing pressure

· The Ovarian market is ~$3bn and platinum resistant Ovarian cancer lacks a widely effective, suitable therapeutic so any faint glimmer of success in the Ovarian trial would more likely be well received

· The phase 1b/2 trial may have shown anti-tumor activity in a difficult to treat population

The drug showed no dose-limiting toxicities and no grade 4 adverse events

The phase 1 part of the trial, with olvi-vec as monotherapy had a clinical benefit rate of 73%, and double the progression free survival (PFS) of chemotherapy

Update

On February 2 the company released an 8K that confirmed our earlier suggestion, estimating their cash equivalents were 23.2mn as of December 31, 2023. This indicates the full private placement funds have still not be received and, more importantly, that given current burn, Genelux may not have sufficient cash on hand to reach the Ovarian trial readout in 2025 without new financing.