Iridex: A Microcap Pump Whose Air Will Run Out

Iridex: A Microcap Pump Whose Air Will Run Out

Name Ticker IRIX

Price 3.14

Shares Outstanding (M)

Market Cap ($M) 51

Cash ($M) 8

Net Debt ($M) 5

TEV ($M) 45.93

Short Interest 1.99%

Average Volume: 107,000 (less than $500,000)

I have followed Iridex for years due to a personal interest in the ophthalmology space. It trades very few shares daily and this writeup will unlikely be actionable for most investors

Description

Iridex was founded in 1989 and yet its press releases still herald its progress to achieving its full potential commercially. After 34 years and declining revenues across product lines, management seemed to throw in the towel after putrid Q2 numbers, stating directly the company has engaged financial advisor Piper Sandler to explore all strategic options. We think the most likely outcome is a dilutive raise to undertake further R&D and trials in the vain hope of being seen more favorably by customers.

Iridex is an opthalmological medical device company focusing on glaucoma and retinal disorders through its proprietary laser systems. Commercialized around a razor – razor blade system, there are consoles, laser systems, and consumables. On the glaucoma side is the Cyclo G6 laser system while the IQ532 and 577 laser systems are used for retinal disorders and various versions of OcuLight treat a myriad of retinal problems including diabetic retinopathy, macular holes, retinal tears and detachments. There is also another business line of delivery services, albeit de minimis compared to the others. Despite a slew of probes and decades of commercial experience, Iridex has not managed to grow into profitability and, in fact, has had declining revenues across the glaucoma and retina product lines.

Investment Thesis

1. In August after yet another quarter of declining revenue, management announced a strategic review. This could include sale of the whole company, sale of a product line or lines, or a raise, which we deem most likely given the lack of profitability for a mature medical device company.

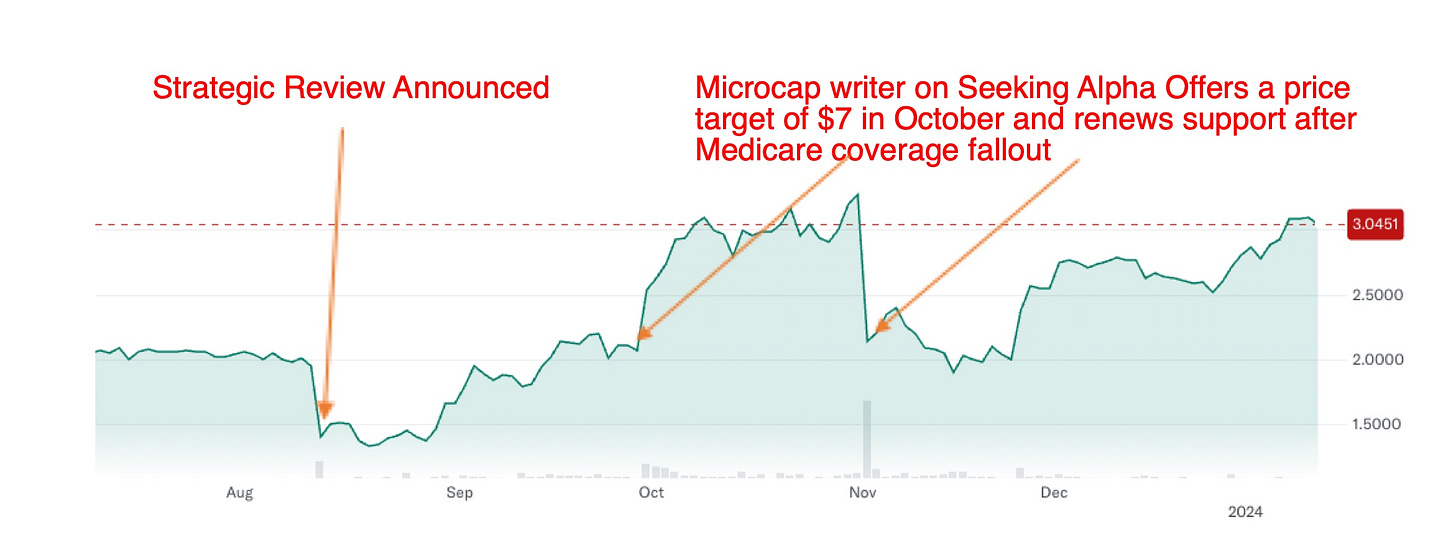

2. As importantly, the stock is up more than 100%, which we believe is largely on the back of microcap promotion, including one writer estimating a minimum fair value of $7 per share.

In a microcap stock, such enthusiasm undoubtedly can influence retail shareholders, who make up ~50% of the investor base.

3. We view the buyout target and valuation of the product lines as detached from reality and creating a unique opportunity to short a stale medical device company unlikely to attract a suitor and more likely headed to a dilutive raise. With retail investors sitting on substantial gains, now is the time to short

4. Given the company is burning cash and has ~1 year of runway combined with costly initiatives including a glaucoma trial to undertake, financing will be needed barring a miraculous uptick in sales, which likely would not fill the company’s coffers given their inability to turn a profit even with R&D capped below 15%. A company without economies of scale for sales and marketing nor a product line capable of attracting interest independently signals a long, painful fade into irrelevance.

Financial Overview

· As of Q4, Iridex had ~8mn in cash on hand and was burning ~2mn per quarter. In other words, it is cash out in 1 year.

· As you can see below, gross margins are on the higher end for medical devices, (typically 30-45%). Despite repeated declarations of investing in new technology, R&D expenses have been on the lower end, which typically range between 13.2%-20%+. In other words, Iridex is not unprofitable because of outsized investment in innovation.

· While the company breaks down its revenues by product line (other includes royalties, which are going away), it fails to include costs broken down by product line. This leads us to assume that retina is less profitable than the aforementioned advocate suggests. Otherwise, why would the company not disclose this since glaucoma has long been viewed as a work in progress while retina is a mature product in a mature market?

Deep Dive on Investment Thesis

1. In Q3, revenue decreased 12% yoy ($12.9mn vs $14.6mn) and was flat sequentially by quarter. While you might hope that this was due to an isolated challenge with one product line, it was actually across both glaucoma and retina. Cyclo G6 revenue fell 12% (27 systems vs 54 systems sold the year prior) due to reduced systems sales even though the company grew its probe (razor blade) revenue 3% in spite of falling unit sales. This suggests that increased pricing accounts for the probe revenue growth. Retina revenue of $7.9mn was a 10% decrease yoy, although it was 15% sequential growth as is expected due to seasonality when Q2 is often quite slow. Among other reasons, these results were attributed to a weak capital equipment environment. Further, Other revenue fell due to what management highlighted the end of a long term royalty contract from patents expiring and reduced service revenue.

2. The retina segment is considered a mature market and yet the company had meaningful R&D expense on a project for retina and had to integrate to its distribution partner Topcon. In other words, the cost profile for retina is unlikely to improve favorably. If one believed it were possible to reduce sales and marketing because of stickiness, it might become profitable for retina and yet it had declining sales. Clearly, even its established products in retina require costly undertaking to maintain market position.

3. On glaucoma Iridex seems to have been blind to the bigger opportunity as it is not in the far more popular MIGS space (minimally microinvasive glaucoma surgery). To generate clinical support for its product, the company has decided to undertake a multi center trial of its product. This will add yet another expense as well as slow increase in sales; after all, what physician would use a product until a large trial is completed to validate (or invalidate) product usage?

4. Finally with sales and marketing as well as research and development only ~15% and 13% of revenues respectively, there really is not a lot of room to cut expenses. A small company that requires a direct to physician sales force lacks the scale to market effectively and has a faustian choice – reduce expenses and thereby revenue or try to maintain revenue by continuing to bleed cash.

Why does the opportunity exist

· This is a unique opportunity driven by animal spirits. A microcap with a small short interest combined with a prolific Seeking Alpha writer incessantly advocating for it (evidence to the contrary be damned such as his cheerleading after an unfavorable Medicare coverage warning) has created a 52 week price high. Retail has moved this stock and when a sale of the retina product line alone or the company altogether fail to materialize, the share price will drop precipitously as they look to lock in their gains. Another microcap enthusiast has also plugged the stock.

· The Seeking Alpha author recently wrote “I will focus most of my time on discussing why I believe the stock is currently a screaming buy, even after shares have rallied around 100% from recent lows. This recent share price appreciation is clearly a result of the strategic review the company has undertaken to “unlock share holder value.””

· The author writes for a stock research site, which interestingly, Scott Shuda, Chairman of Iridex, contributes to as well. This might suggest the author has unique insight. We do not question his probity, but given his track record with Iridex to date and the data before us, we believe the past is the guide to the future, with Iridex sure to disappoint the current batch of feverish followers.

· At the outset of the strategic review announcement, the same author declared “I will show why I believe the company is ultimately going to separate its two businesses—retina and glaucoma—and how this will significantly benefit current shareholders. In fact, I will make the argument that if IRIX chooses that route, the company should be worth at least $7.00/share, or nearly triple current values.” Who wouldn’t want to get on that rocket ship? We declined this vaporware, missing out on the retail ride up and hope to cash in on the crash down.

Historical and Projected Financials

· Net loss in q3 was $1.8mn, which was the same as the year before. Q2 net loss was $2.8mn as operating expenses fell to $7.3mn from $8.2mn due to “cost optimization efforts”. Cash and cash equivalents totaled $8.0 million as of September 30, 2023. Cash use of $1.8 million in the third quarter increased compared to $1.2 million in the second quarter of 2023. The company announced that inventory reductions should help drive Q4 cash usage down. This is, of course, a temporary salve as inventories will need to be restocked if the company is to maintain revenue if not grow.

· Two years ago, in 2021, Iridex entered into an agreement with large ophthalmological player Topcon for a $20mn equity investment. Topcon purchased 10% of the company at $6.18 per share and also acquired the PASCAL product (retina) line and distribution rights.

Catalyst

· Q4 revenue numbers will tell an important story – if retina revenue continues to decrease, the product category for Iridex may be on its deathbed and a suitor will not save it. We already consider it an unlikely takeover target since Topcon has distribution rights and the sales to date have been declining in a mature market. In other words, Topcon is the most likely acquirer, would likely be a discouraging presence for another acquirer and has no incentive to buy it outright since it has all the benefit without the hassle.

· Lack of a buyer – at some point retail will lock in gains if a buyer does not seem in the offing. With paper profits of 50 - 100% for the acolytes of the previously cited author started promoting a $7 per share buyout, those same retail investors will seek to actualize profits when a buyer fails to materialize or a dilutive raise, which we consider most likely given the share price at a 52 week high, occurs.

Valuation and why

· EV ~$30mn (or ~$1.4 per share) – this was the valuation after the disastrous Q2 earnings, which were reinforced in Q3. In between the strategic review was announced. Note that this represents approximately ~.6 x revenues, which if we teased out R&D of 13% against a loss of ~15% suggests close to break even. If we assume most (2/3) of the R&D is due to glaucoma, which given that it is earlier in product development would be reasonable, the retina line by itself should be slightly profitable. ~1 x revenues gives us a margin of safety and 10 x EBITDA of retina would be ~$30mn. Ultimately, we expect the company to raise, driving the share price lower

· Please note that since the company does not break out financials for retina and glaucoma it is difficult to know margins

· The retina market and Iridex’s retina line are not growing and have more price competition due to retina being a mature market

· Poor adoption of the glaucoma product and the need to run a study to try to show efficacy add yet another expense. Poor physician adoption was demonstrated by the need to automate the glaucoma procedure because of inadequate provider uptake

· Iridex dodged a bullet in Medicare Administrative Contractors (“MACs) withdrawing their initial guidance for “Local Coverage Determination” (the “LCDs”) that would have restricted coverage of Iridex’s G6 laser system and probes for glaucoma patients. Even though the LCD guidance was withdrawn, it highlights a risk to the business, which is already suffering declining sales. In other words, we view an EV of $30mn as a high water mark.

Risks

· The biggest risk is if Topcon, the most likely buyer, decides to acquire the retina line or buy the whole company. It has already paid $6.18 per share for 10% of the company. However, we view the terms of that deal favorable enough and upside of the retina lines unattractive enough that Topcon has little incentive to expend additional resources.

· The burn will likely slow as inventories are being sold down, which should improve the net loss for Q4.

· By far the biggest risk is if the company manages to sell its existing NOLs, which are 25mn. This would extend runway and give a boost to a pumpy stock. Of course, this would only delay the vision of a company that disappears, not ensure its survival