Name aTyr Pharma

Ticker LIFE

Price 1.91

Shares Outstanding (M) 58.56

Market Cap ($M) 111.85

Net Debt ($M) -86.91

TEV ($M) 24.75

Cash ($M) 105.6m as of Oct 1, 2023

Burn ($M) 11.34 quarterly

Runway q2 2026

aTyr belongs in the buy and hold bucket given the lack of imminent catalysts and, as such, we view 2024 as an excellent opportunity to accumulate shares. Ultimately, it is a platform play focused on critical unmet pulmonary diseases.

Description

aTyr Pharma, which we will also refer to by its favorable ticker LIFE, is a biotech company focused on tRNA synthetases in pulmonary diseases. tRNA synthetases are enzymes critical to the first step in protein translation, catalyzing the reaction by linking an amino acid to its cognate tRNA. Its most advanced drug candidate, currently in phase 3, efzofitimod is a selective modulator of NRP2 for pulmonary sarcoidosis. It is also being tested in a Phase 1b/2a for interstitial lung disease (ILDs) SSc-ILD and other trials including chronic hypersensitivity pneumonitis and connective tissue diseases related ILD. In addition, it has a preclinical candidate in the monoclonal antibody ATYR2810 for solid tumors.

The next expected catalysts will not be until 2025.

Investment Thesis

1. LIFE is well capitalized to reach valuation inflection points, including a phase 3 readout and BLA application for its farthest along drug candidate, efzofitimod in pulmonary sarcoidosis. It is a platform play with a novel class of medicines – tRNA synthetases. The lack of imminent catalysts means that it is not receiving significant attention, as demonstrated by the reaction to expanded access, creating a buying opportunity as share prices have yet to appreciate.

2. Pulmonary sarcoidoisis is characterized by non-caseating granulomas. Efzofitimod evinced a clinical proof of concept in Phase 1b/2a trial for pulmonary sarcoidosis, meeting both primary and secondary endpoints, suggesting the phase 3 trial for pulmonary sarcoidosis may be successful.

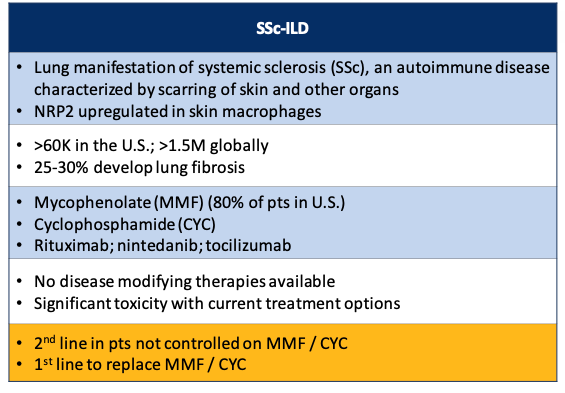

3. It is also in the clinic with efzofitimod for SSc-ILD, which is a pulmonary version of systemic sclerosis (SSc), an autoimmune disease characterized by scarring.

Financial Overview

· Runway through BLA application for efzofitimod in pulmonary sarcoidosis

· As of q4 2023, the company had 105.6mn cash on hand

· Filed a 300mn mixed shelf in November 2023 for housekeeping purposes, ie they have no imminent plan to use it

· They are using the ATM

They use it for $1mn a month based on how the stock is trading (that is also the historical monthly usage) and started tapping the current one in 2023

The current ATM is with Jefferies for $65mn, the previous one was with Jones Trading and the one before that was with HC Wainwright

Deep Dive on Investment Thesis

Headquartered in San Diego and based off of research at local institution Scripps, LIFE’s principal drug candidate, efzofitimod, addresses the severely under-served interstitial lung disease (ILD). This is an immune mediated group of disorders, characterized by pulmonary inflammation and fibrosis, aka scarring. By modulating tRNA synthetase, inflammation is reduced without immune suppression, improving lung function resolving symptoms and halting disease progression. It is not however expected to reverse fibrosis, though fibroblasts do express NRP2. LIFE has IP covering more than 300 protein compositions from all 20 tRNA synthetase genes

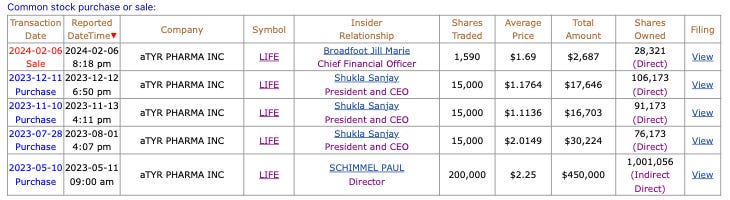

The company is well capitalized to achieve its registration endpoint and surrogate endpoints in the phase 3 trial for sarcoidosiså. Further validating confidence in the prospects of the company, in the past year, there have been a total of $514,573 buys or 245,000 shares purchased versus $2,687 or 1,590 shares sold. 15,000 shares were purchased on 3 separate occasions by the President, who is also the CEO.

secform4.com

aTyr’s furthest along clinical trial is known as EFZO-FIT™. It is a phase 3 global trial and is investigating efzofitimod for patients with pulmonary sarcoidosis. While the trial will likely not complete enrollment until q2 2024, an early validation appears to be compassionate use approval, also known as Individual Patient Expanded Access Program (EAP) for those suffering from pulmonary sarcoidosis. The first phase 3 patients enrolled (September of 2022) completed the trial and wanted to continue taking the drug (though they could not be sure they were in the non-placebo arm). While the study was blinded, the company suggested they had positive feedback from those initial PIs and patients.

Similarly, the collaboration and research agreement with Kyorin Pharmaceutical for efzofitimod development and commercialization for ILDs in Japan, bolsters confidence in the platform. In the third quarter press release, LIFE’s CEO noted “we had a positive data and safety monitoring board (DSMB) review for our global pivotal Phase 3 EFZO-FIT™ study in patients with pulmonary sarcoidosis”.

The drug works by downregulating activated myeloid cells via NRP2. In a phase 1b/2a study of 37 patients, it was safe and well tolerated, with dose response improvement observed to inflammatory biomarkers. This clinical proof of concept showed efzofitimod to be a first-in-class biologic ILD immunomodulator. The Phase 3 trial involves randomization across 3 groups in a 1:1:1 ratio. 1 group receives 5mg/kg, 1 group gets 3 mg/kg, and the third has placebo. Primary endpoint is at 48 weeks and is steroid burden, ie change in daily steroid use with key secondary endpoints of lung function (forced vital capacity and symptom control, ie KQ-Lung score). This trial should finish in 2025 and readout in q3 2025.

LIFE is at full site activation and anticipates enrollment completion in q2 2024. The trial expanded to Brazil at the end of 2023 based on PI interest and demand. The last country they were targeting in Europe was Germany and that is activated too. Based on discussion with the company, at this point, they hit as much as they intended and planned for geographic sites.

In the phase 1b/2a they saw clinical proof of concept. Technically, the primary endpoint was safety and secondary endpoints were steroid reduction, quality of life, biomarkers and symptoms. They saw dose improvement, but didn’t see any improvement in 1mg compared to placebo for many exploratory endpoints. As a result, they view the 1mg as sub therapeutic and are not including it in the phase 3 trial. For 3mg and 5mg does, they did see improvement for average daily dose of steroid and also FVC among others and quality of life symptoms. KOLs described the endpoints as all moving in the right direction with removing some of the steroid. The FDA supports their published conclusion that the trial achieved clinical proof of concept.

q3 2023 saw the first patient dosed in the Phase 2 EFZO-CONNECT™ study for patients with systemic sclerosis related ILD (SSc-ILD). There are limited therapeutic options for SSc-ILD. As in other ILD diseases, there is chronic inflammation via NRP2 upregulation and this can lead to progressive fibrosis.

Why does the opportunity exist

· First, this represents a platform play, with extracellular tRNA synthetases potentially becoming a new class of therapeutics, whose IP aTyr owns. There are no safety issues to date as the drugs target innate immunity and downregulate inflammatory pathways while not causing immune suppression.

· Second, since there are no readouts for some time, the stock seems to have been forgotten, with the notice of EAP moving the stock north only ~10%.

· An investment in this stock requires patience, which given the short term XBI burst, creates an opportunity cost. We view the long term valuation warranting an opportunistic investment significantly ahead of catalysts.

Catalyst

· There are no anticipated catalysts in 2024. The Phase 2 readout should be first because it only has 28 patients, but they have not provided any updates on the progress other than the first patient was dosed in q4 2023

· LIFE anticipates the pulmonary sarcoidosis phase 3 readout in late q2 2025 or early q3. Phase 3 is 52 weeks, including a 4 week follow-up, so from the date that they announce the enrollment is complete it’s a minimum of 12 months and some time to prepare the data to read out. Enrollment completion will probably be in q2 2024.

Valuation and why

aTyr is focused on ILD, which covers more than 200 types of rare lung diseases across the spectrum of inflammation and fibrosis, resulting in high morbidity and mortality. There are currently no suitable therapeutics available. Furthermore, there is potential relevance to other ILD and autoimmune disease such as lupus and rheumatoid arthritis, as demonstrated in a recent presentation.

Efzofitimod represents a 1st line treatment for a market estimated in 2023 to be 17.6bn and growing 10.6% annually. Conservatively, aTyr estimates its market to be up to $3B for ILD. There are no disease-modifying therapies currently available and current therapies exhibit toxicities. To understand the market size, there are 200,000 pulmonary sarcoidosis patients in the US and 1mn in the world. Up to ¾ of patients uses oral corticosteroids (OCS), 30% use immunosuppressants and 10% use anti-TNF antibodies. With ~58.56mn shares outstanding, sarcoidosis being ~1/4 of ILD patients, ¼ x $3B for ILD with a 3 x multiple, we should assume based only on the pulmonary sarcoidosis indication $40/sh, which is 20x the current share price. A buyout might be much higher given there are other candidates, including SSc-ILD

There are 60,000 patients with SSc-ILD in the US and more than 1.5M globally with 25-30% developing lung fibrosis. Since there are no SSc-ILD diseases modifying therapies, it is set to become 1st line treatment.

Risks

· As with all biotechs, the trials could fail, including but not limited to adverse events, lack of efficacy or other issues

· The SSc data will likely be the first catalyst and this is is less studied than the pulmonary sarcoidosis phase 3, which we have more confidence will be successful given the clinical proof of concept.

· The company will need to raise additional funds, causing further dilution, as seen by the ATM

· Competitors

o aTyr is the only one in a phase 3

· Novartis – CMJ389

o Novartis has stopped its program and is eliminating its respiratory business as a whole. aTyr continues to track it, but doesn’t believe it’s being explored

· Kinevant Sciences GmbH - Namilumab

o they are actively enrolling and aTyr keeps tabs on them. The CEO and head of clinical don’t consider the mechanism logical given it has been tried in so many other diseases

· Relief Therapeutics - RLF 100

o aTyr doesn’t think much of them as a competitor because no PI or others are asking about it

· Molecure

o It is interesting but too early to tell

· Zentria

o Repurposing a tnf and not concerned